Sign the entrance to a capital forest bank branch in Manhattan.

Eric McGregor | Lightrocket | Getty images

Capital a financialApplication for Acquire Search for financial services One in $ 35.3 billion all-stock deal Is officially done allowed By the Federal Reserve Board and the Comptroller Office of the currency, the regulators announced on Friday.

The Federal Reserve Board said in a release, “The board evaluated the application under statutory factors, which requires considering the companies’ financial and managerial resources, the convenience and requirements of communities to be served by the joint organization and the competitive and financial stability effects of the proposal.”

Capital a first Announced It entered a certain agreement Acquire Discover in February 2024. This will indirectly acquire the Discover Bank through transactions.

Under the agreement, the Discover shareholders will receive about 26% premium from the closing price of 1.0192 capital forest share or discover for each discover share, at that time the Capital One said in a release.

Capital Forest and Discover are among the largest credit card issuers in the US, and the merger will expand the deposit base of Capital One and the offerings of its credit card.

In a joint statement, Capital One and Discover stated that they expect to close the deal on 18 May.

As per the release of February 2024, after the deal closure, the capital forest shareholder will organize a 60% joint company, while the shareholders’ discovery is 40%.

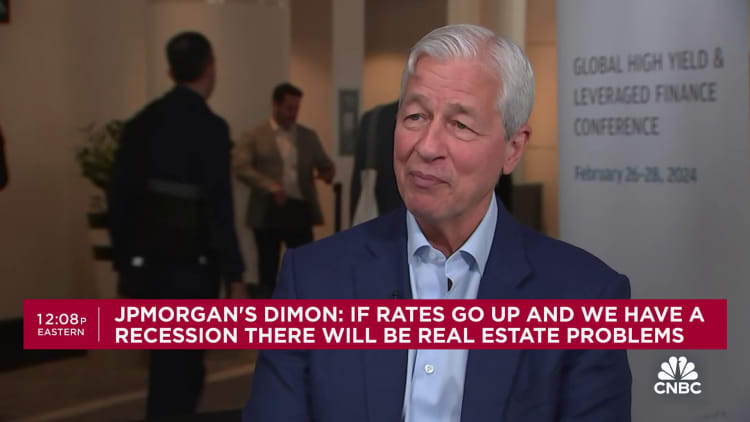

Watch: Jamie Dimon on Capital One’s $ 35.3 billion discovery acquisition: ‘Let them compete’